Mobile banking has solved a row of issues, such as annoying queues and looking for nearby terminals or ATMs.

This fact has conditioned enhancing statistics of banking applications.

Allied Market Research shows that the mobile banking market was evaluated at $715 million in 2018 and is projected to reach $1,824 million by 2026. Thus, global banking has brought lots of advantages to our society with digitalization.

In this article, we’ll provide a thorough guide on banking app development covering all the peculiarities, features to implement, and pitfalls to building flawless software.

Let’s begin!

Benefits of Mobile Banking for Business

Like any other digital product, banking applications are certainly paving way for businesses to enter the world of finance. And not just the big shots, banking applications have also simplified the life of every person. They need not stand in long queues, can access their banking detail on phones; technically, they have their banks at their fingertips.

The main points that advance banking platforms are the following:

- Top-notch service

- Progressing number of customers

Here’s a list of benefits allowing expanding your business.

#1. Wider Client Base

In-app banking is convenient and efficient for customers. Thus, such a handy solution attracts them and provides online banking services with the help of an app.

#2. New Marketing Channel

Your banking app will also serve as a promotion for your business. By implementing push notifications into it, your users will be updated with new features, credit services, rates, etc. Thus, you’ll be in a more tight connection with your audience. Remember that there are push notification character limits so be clear and concise with your message.

Also Read: How Micro-interactions Help Business Build A Better Product

#3. Good Return on Investment Ratio

A great platform for online banking will quickly offset development expenses. Some banks invest enormous sums in maintaining their physical departments, while banks with applications reduce costs by enhancing their solutions by degrees.

#4. Efficient Data Source

The data of your banking app users you possess is helpful for further business expansion. You can gain digital insights into various trends and behavior of your audience. By onboarding clients concerning how to buy online, payday loans, and complete other actions with your app, you may track user behavior patterns and apply them for a platform enhancement. In addition, there are other pros you can take from this data:

- Providing more individual approach and experience

- Detecting app flaws

- A clearer view of user's needs and pains

Steps to Take Before The Banking App Creation

Prior to hiring a software development dedicated team and proceeding to the banking app building, you should prepare thoroughly. Thus, your product will definitely succeed.

Step #1. Market Analysis

Such research will reveal market opportunities, competitiveness level, and app idea relevance. Big market players offer full-fledged software to the target audience and integrate the latest trends to be in-demand, which you may also define.

Here are some of the technologies worth implementing in 2022 to satisfy the clients and advance your app:

-

Voice control. This feature provides convenient accessibility and navigation using the voice.

-

AI for data security. Artificial Intelligence is a great technology to prevent fraud and protect user data and financial operations. It tracks transactions and suspicious user behavior. You can hire AI engineers to add AI features to your app.

-

Entire digital banking. Banks existing exceptionally online are quite sought-after, as modern society is in the constant rush with the lack of time to go to the physical bank and wait in a long queue. This is beneficial for both sides: banks save expenses with no need to invest in branches maintenance, while customers receive are delivered with an excellent customer experience.

Step #2. Researching Target Audience

For the maximal relevance of your software, you should study the requirements and challenges of users which have to be overcome with your app.

Open Banking platforms embrace an audience of very diverse ages. Yet, each group will use the app for different purposes. To illustrate, users aged between 18 and 25 commonly apply such solutions for small financial transactions, online shopping, or university fees. The older clients complete more complex actions, such as paying utility bills, sending average or enormous sums, cash flow management, etc.

Step #3. Competitor Studying

The analysis of successful competitors’ products mentioned above may indicate what services and features attract clients and are demanded. Thus, you’ll be able to assess the uniqueness of your solution.

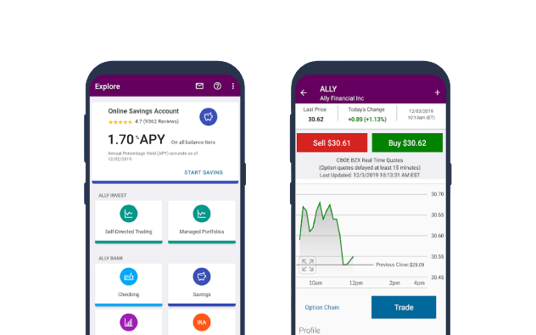

Here are some excellent illustrations of banking apps existing on the market:

- Ally Bank

Ally Bank is an app that is cross-functional and supports both iOS and Android with primary functionality, such as deposit check, transactions completion, bill payments, ATM locator, and a trade stock feature.

- Capital One

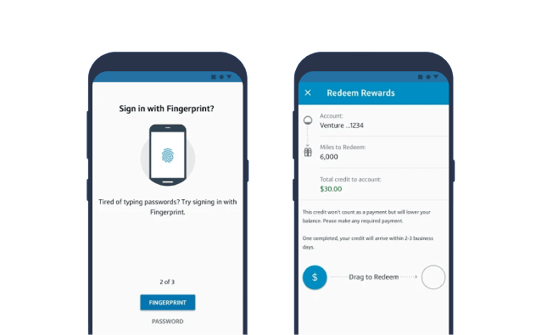

This high-rated app offers fingerprint login, credit history tracking through notifications, and card freezing in case it gets lost.

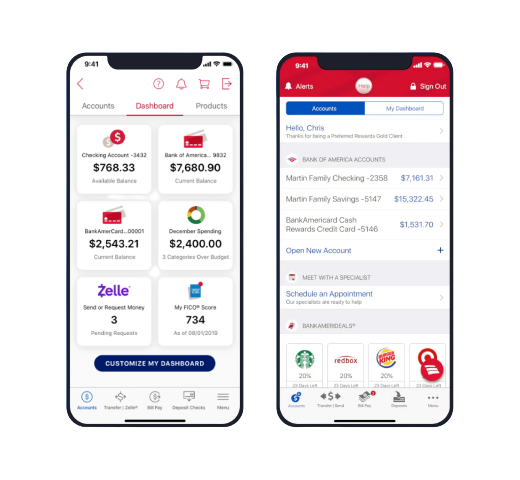

- Bank of America

Bank of America provides its customers with high security by sending notifications if it detects unusual actions. Besides, you can order and activate a virtual card online.

Essential Features for Mobile Banking App Creation

When you are building a mobile banking application, there are quite a number of features that it should have. And these are not just limited to the features for users to view their bank details or features pertaining to their privacy. Todays's users ant more than that.

Here are the primary features to include to create the app functionality.

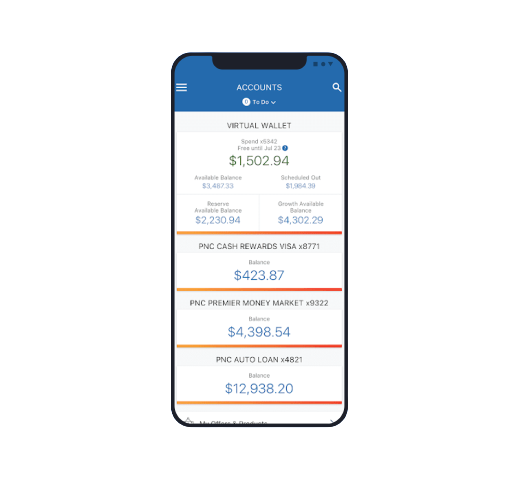

Account Management

This basic feature allows:

- Balance checking

- Cards and banks operating

- Transactions tracking

- Deposit checking

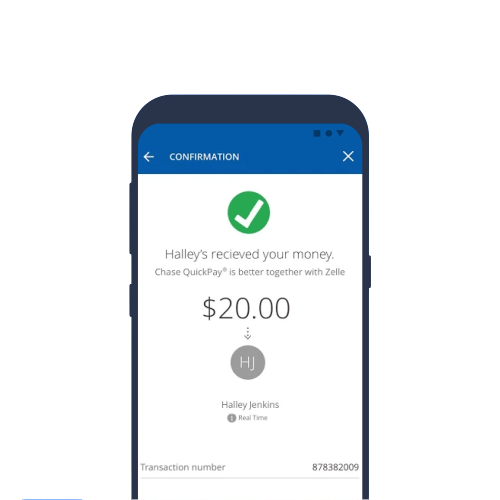

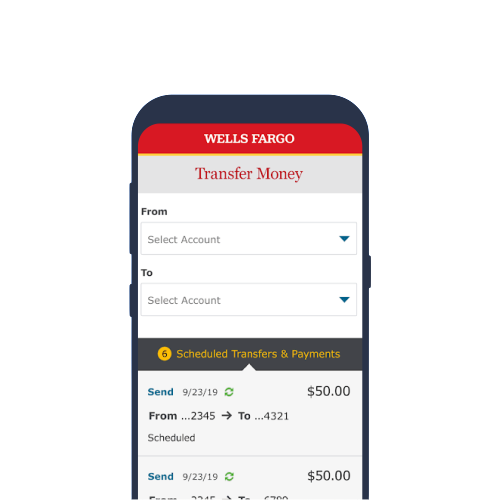

Conducting Transactions

Quick and convenient financial operations are an indispensable part of all banking apps. While the backend processes the money transfer, the front displays the operation’s result.

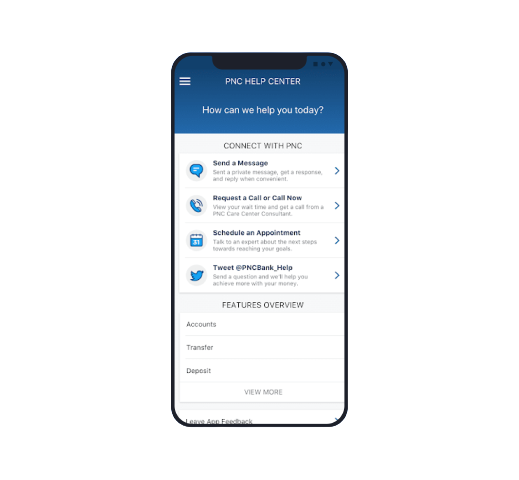

Support Center

Clients should be able to get instant help on their bank-related issues. The support center in your app will give them an opportunity to receive consultation via online chat with the assistant. Another more complex solution for this is to integrate a chatbot into your banking app.

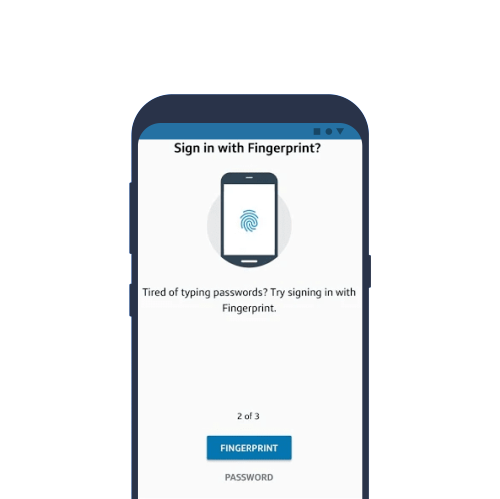

Safe Authentication

Convenience and high protection of entering the app may be completed with the two handy and widely- used methods:

- Applying password

- Applying fingerprint

Push Notifications

Notifications keep users up with everything concerning the bank and financial operations. Here are their existing types:

- Transactional notifications, which provide information concerning the money operation

- Advertising notifications, which serve as a promotion and offer various discounts

- App-based notifications, which request document verification, inform about new logins, etc.

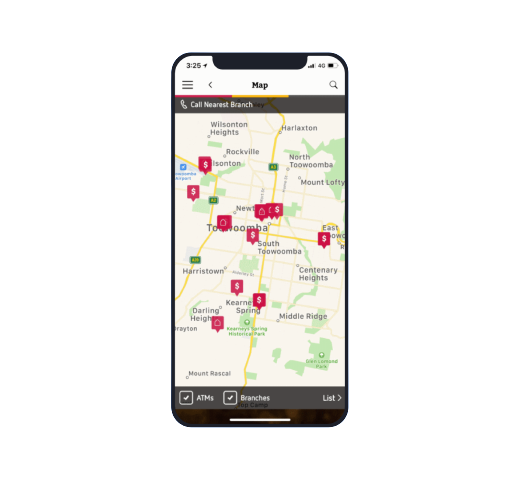

ATMs and Branches Geolocation

This feature implies the map displaying the nearby ATMs and branches, including their opening hours.

QR Code Transactions

Sending a payment with the help of QR codes, for example, for tickets purchasing, is easy and convenient, which makes this feature worth implementing.

Extra Features

To decrease time-to-market, you may update your banking app with such features after launching it.

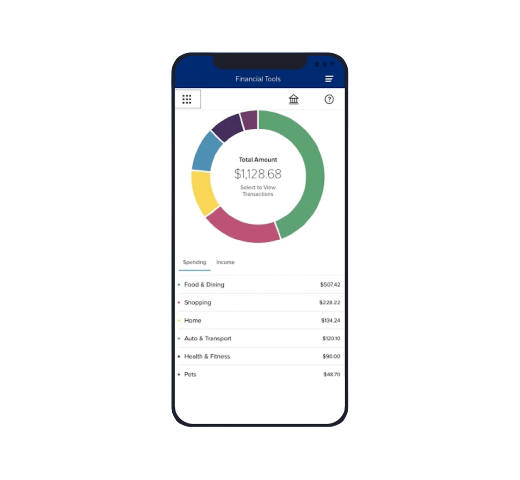

- Expenses Tracker

Customers can receive the statistics of their spendings assembled in a laconic graphic. It should comprise expenses of various time periods and be split into different categories (restaurants, entertainment, health, sports, etc.)

- Saved Payments

In case users conduct repetitive payments, it’s an excellent idea to provide an opportunity to save the credentials with no manual entering each time. There are two methods for this:- Auto debiting

-

Payment reminder

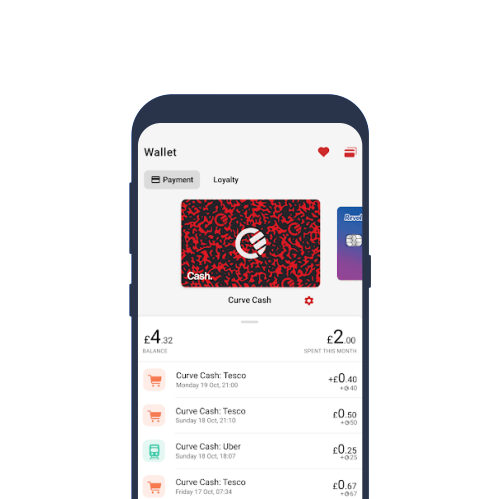

- Cashback

Returning a small sum to customers is a brilliant method to attract a broader audience. Commonly, banks allow clients to select categories they’ll get the cashback from.

- Bill splitting

This feature is elementary yet, so demanded. Users can conveniently split the bill with no need to open the calculator.

How to Create a Banking App: Essential Steps

It’s high time to describe integral phases of the banking apps’ development flow:

Step #1. Prototype Creation

By creating a prototype, you may test how the app operates in a real environment and its efficiency for your target audience. Here are some prototypes’ advantages:

- Modification flexibility

- Reduced costs

- Easier bug fixing

You may gather feedback on your app from the first users for further application modernization and enhancements.

Also Read: How Much Does MVP Development Cost?

Step #2. Powerful Protection

Data safety is vital in terms of banking app development, so here are some key ways to ensure high security:

- Data encrypting (SSL and 256-bit encryption). The data encrypted with such algorithms may be decrypted only by a user with an appropriate key.

- Source code obfuscation. It implies making source code difficult to read and comprehend.

- Repackaging security. Repackaging is completed by an attacker possessing a copy of your product, adding malicious features, and re-sharing it to users who think the digital product is supercharged with functionalities and is totally legit.

Let’s list the most popular and potent methods to secure the app:

- Generated codes transactions verification

- Two-factor verification

- Changing login info regularly

- Fingerprints and FaceID verification

Step #3. Hire Development Team

To build a successful product, you should apply to professionals. You need to choose a custom software development company that ticks all the boxes. It should have required experience in building FinTech products, and should also have the tech expertise to add all features and functionalities. Nowadays, the market is full of a great diversity of offers, so to find the most competent and suitable ones for your case, you should check such credible platforms as:

- Clutch

- GoodFirms

- IT Firms

Also Read: How We Built A Loan Application Management Software

Step #4. Launch Your Product and Get Feedback

Depending on the chosen platform, the app launching requires guidelines and regulations of App Store or Google Play compliance.

This would be your minimum viable product or the first prototype. The first users will provide you with reviews and enhancement recommendations. This insight should be used to keep enhancing the app in terms of customer experience, features, functionalities, and more. It’s is beneficial, as you may update the app according to such suggestions.

Mobile Banking Development Challenges

The complexity of banking app creation lies in the following points:

Tech challenges

- Auto-fill. It should be unavailable in every UI space for information input to avoid data being extracted by malware.

- Blur. When the users open and close the banking app, its screen should stay blurred to protect the information it contains.

- In-memory data storage. This storing method appropriate for banking platforms implies total data removal after deleting the app. Therefore, it prevents possible unwanted extraction.

Regulations

Building a banking app requires compliance with a row of regulations:

- GDPR Compliance: Ensure GDPR compliance in regards to all personal data for all companies that provide goods and services for European Union.

- PCI DSS Compliance: This compliance is required for any service vendor who possesses, processes, and transfers credit card details.

- SEPA Compliance: It’s essential for companies from European Union and other European countries which support the euro in financial operations.

- PSD2 Compliance: This regulation is obligatory for payments made in the European Economic Area.

Summarize

The banking app is a complex yet, profitable software. The creation peculiarities and pitfalls, especially those related to the security standards, are worth involving experts to build a successful product. Consequently, by applying to a trustworthy software development company, you’ll get competent partners, who will cope with all the tech challenges and create a top-quality app that will efficiently serve your customers.

.jpg)